With all the ups and downs, the U.S. stock market has historically given around 7% annual returns. (Including inflation.) (1)

The long-term can take a long time to play out, so patience is important for achieving the best return on your invested dollars.

We’ll review some basic principles and strategies that can help you achieve that.

Know Your Time Horizon

Your time horizon is your investing timeline. The length of time you invest to when you need to start selling some of your investments.

A capable financial advisor will select your investment portfolio’s assets based on your time horizon, which might change the closer you get to retirement.

Know Your Risk Tolerance

This is the level of comfort you have with taking investment risks.

Your risk tolerance will typically be higher if you have a long time horizon, like 10+ years. That means you can tolerate above-average volatility in the short term for a better long-term return.

Typically, riskier investments like equity funds have more volatility with a greater return. In contrast, less risky assets like GICs are safer but more stable.

Diversify your Portfolio

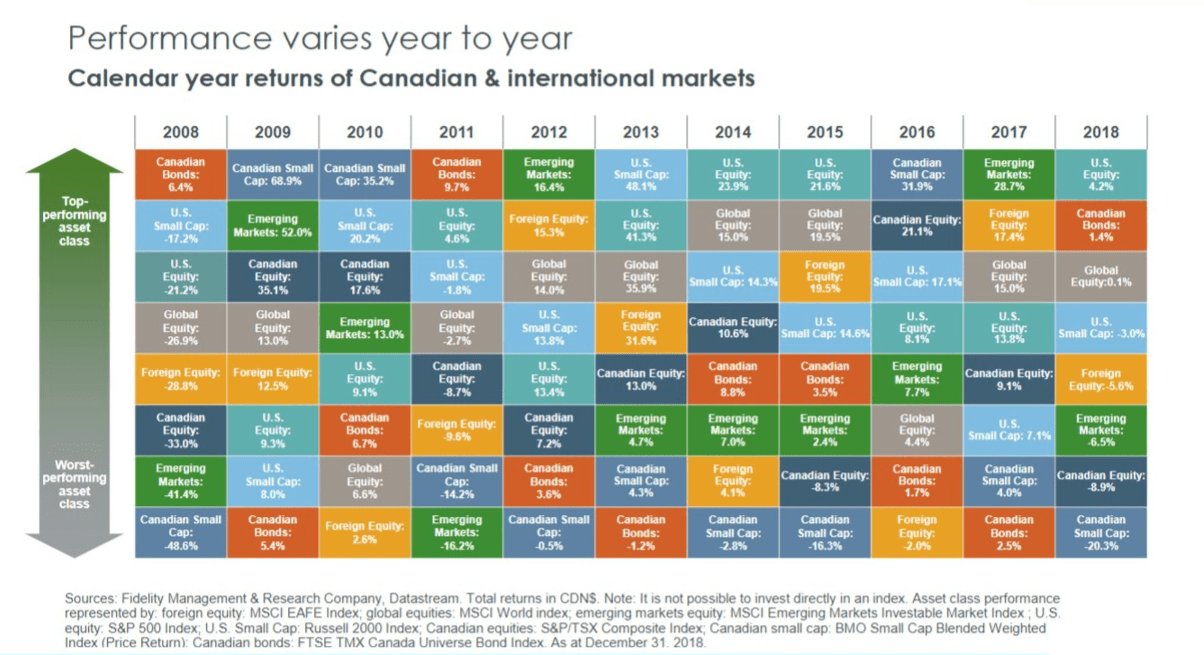

The Fidelity chart below shows asset classes’ annual returns from 2008 to 2018.

It’s a busy chart, but you might have noticed performance varies among ALL asset classes.

For example, Canadian Small Caps returned 31.9% in 2016 but only 4% the following year.

That’s why we recommend having a diverse investment portfolio that matches your time horizon and risk tolerance. Putting too many eggs in one basket increases the risk of low or negative returns in the short term.

Dollar Cost Averaging

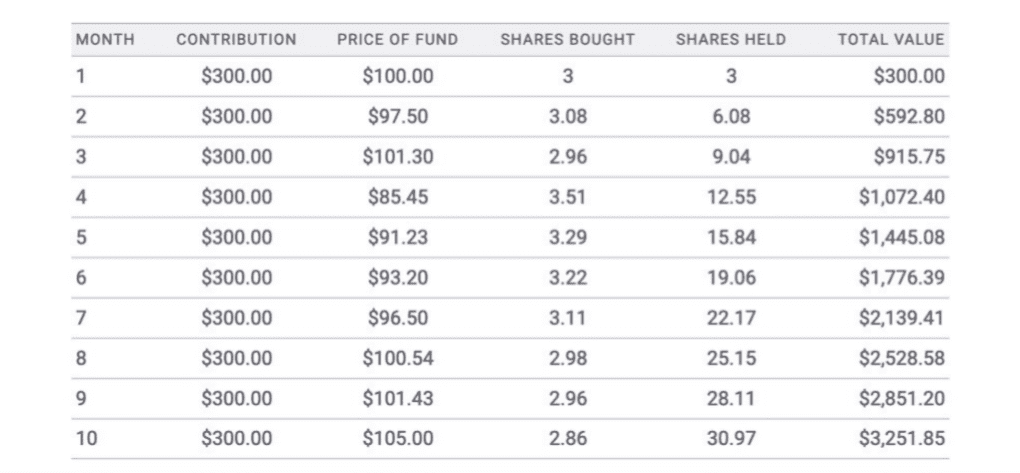

This strategy makes it easier to deal with uncertain markets by making investment purchases automatic. Dollar-cost averaging also supports an investor’s effort to invest regularly and reduce the impact of volatility.

It invests the same amount of money in a portfolio at regular intervals over time, regardless of price.

The image below shows an example of dollar cost averaging monthly with a $300 contribution.

Compound Interest

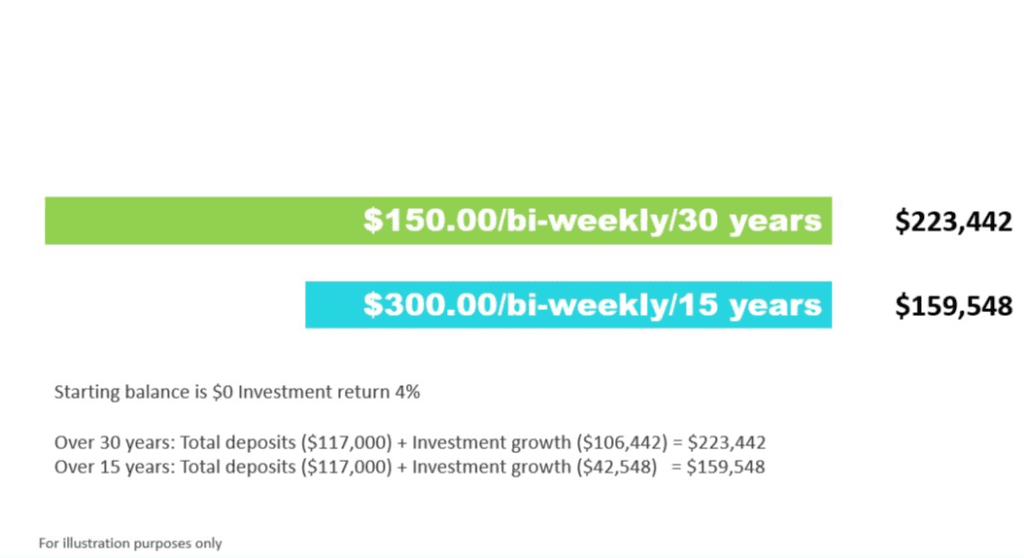

Investors with a long time horizon benefit the most from compound interest. When you invest over a long period, your money has more time to compound.

The following example compares investing over 30 years to only 15 years with the same 4% return and total deposits of $117,000.

We’ve recorded a video on these exact basic principles and strategies. If you’d like more details, then click here to watch it.

Source 1: SEC Saving and Investing